Introduction

The Asia Pacific urea market in 2026 is shaped by steady growth in agricultural demand alongside gradual capacity expansion across major producing countries. Procurement strategies increasingly focus on managing import dependence, policy-driven supply constraints, and logistics reliability as fertilizer consumption remains central to food security across the region.

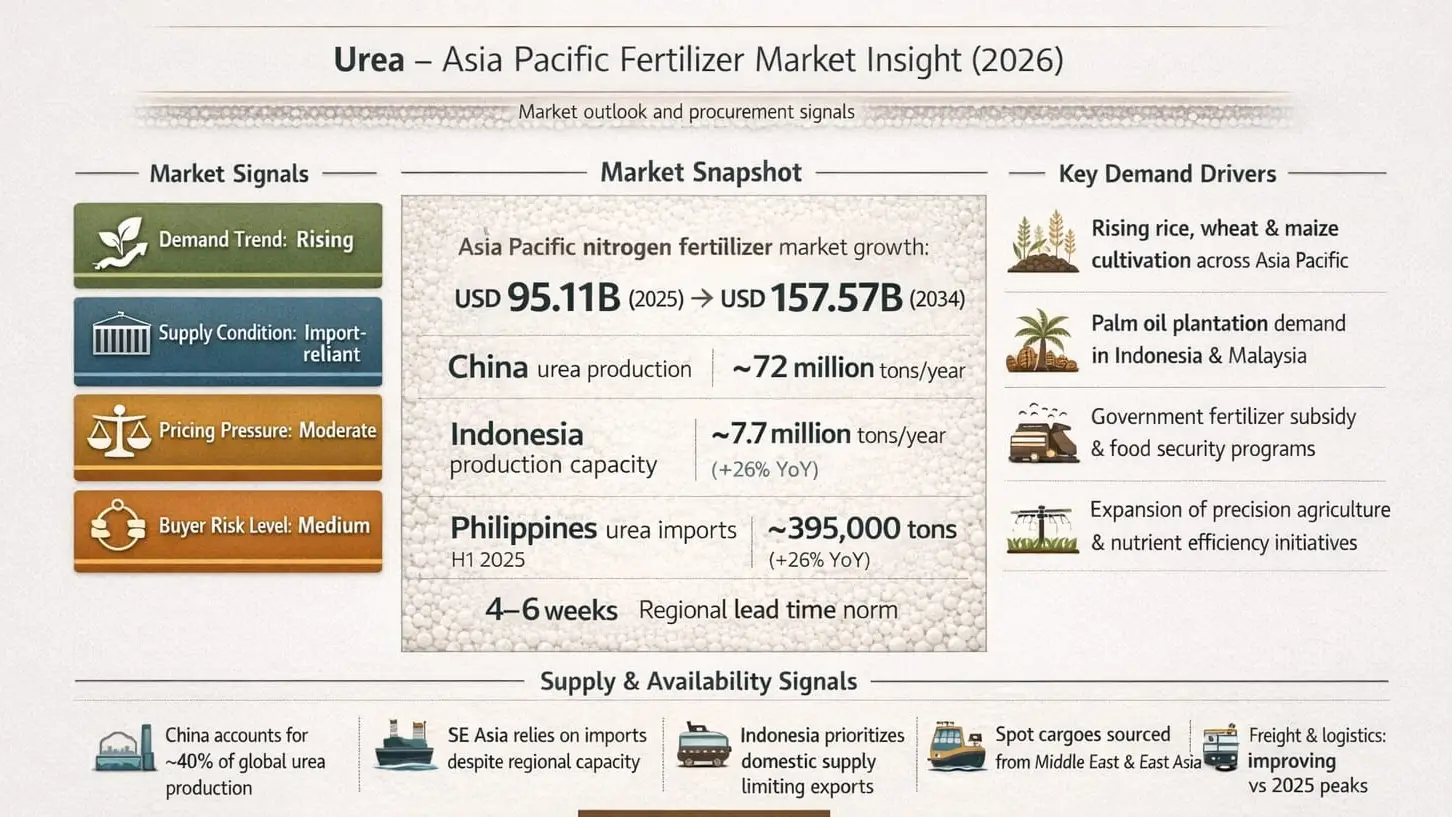

Market Signals for Urea (Asia Pacific, 2026)

Demand trend: Rising

Asia Pacific nitrogenous fertilizer market, led by urea, projects growth from USD 95.11 billion in 2025 to USD 157.57 billion by 2034, driven by rice, wheat, and maize cultivation.

Supply condition: Import-reliant

Southeast Asia remains roughly balanced but with significant importers like Thailand, Myanmar, and Philippines relying on deliveries from Indonesia, Malaysia, Brunei, and China.

Pricing pressure: Moderate

Urea prices expected to decline 7% in 2026 after 2025 tightening, influenced by new East Asia capacity and easing freight from USD 477.67/MT quarterly averages.

Buyer risk level: Medium

Chinese export quotas, domestic prioritization in Indonesia, and logistics variability in island nations elevate lead time uncertainties.

Current Market Snapshot

Asia Pacific urea trade flows remain broadly balanced, supported by surplus production in key exporting countries. China produces approximately 72 million tons annually against domestic consumption of around 65.5 million tons, allowing export availability as capacity targets approach 75 million tons by 2025. Import activity remains strong in deficit markets, with Philippine urea imports rising 26% year-on-year to 395,000 tons in the first half of 2025, sourced primarily from Brunei, China, and Vietnam. Pricing softened toward the end of 2025, reaching around USD 0.23 per kilogram in Northeast Asia as demand weakened seasonally and Chinese output remained steady. Freight costs into Southeast Asia also eased, improving landed cost predictability for importers.

Key Demand Drivers

Agricultural intensification remains the primary demand engine for urea across Asia Pacific. In Indonesia, rice cultivation dominates fertilizer usage, particularly across Java and Sumatra, while palm oil plantations continue to absorb significant nitrogen volumes. In China and India, population-driven food demand and modernization of farming practices sustain fertilizer consumption for wheat, maize, and corn. Regional demand growth of 4–6% through 2030 is further reinforced by government subsidy programs, expanded access to precision irrigation, and broader adoption of nutrient-efficient farming methods aimed at improving yields and reducing input waste.

Supply & Availability Signals

China continues to anchor global urea supply, accounting for roughly 40% of worldwide production, with capacity nearing 75 million tons by 2025. India is also expanding output, with an additional 9.46 million tons per annum planned through 2030 to reduce reliance on imports. Indonesia remains Southeast Asia’s largest producer at approximately 7.7 million tons per annum but is increasingly prioritizing domestic distribution. New projects such as Pusri-IIIB and Fakfak will further strengthen internal supply, while export availability declined to around 1.4 million tons in 2024. Buyers supplement regional sourcing with spot cargoes from the Middle East and Persian Gulf, though export quotas, natural gas constraints, and logistical challenges, particularly in eastern Indonesian islands, limit overall reliability.

Buyer Considerations

Procurement teams are advised to engage suppliers with confirmed export quota access from China and Indonesia to reduce policy-related risks. Participation in structured tenders, including granular urea offerings such as Pupuk Indonesia’s periodic sales, can help secure volumes at predictable pricing. Environmental compliance continues to gain importance as regional regulations tighten, especially for export-oriented agriculture. With lead times averaging 4–6 weeks, forward contracting is essential to mitigate freight volatility and port congestion. Buyers should also diversify sourcing portfolios beyond single-country reliance and closely monitor natural gas prices, which account for 70–80% of urea production costs, alongside currency movements affecting landed costs.

How These Market Signals Are Interpreted

Demand indicators are derived from rising import volumes into structurally deficit markets, particularly the Philippines, and expanding fertilizer application in rice and palm oil cultivation. Supply conditions reflect significant capacity growth across Asia but persistent import dependence in Southeast Asia due to domestic prioritization policies. Pricing pressure is assessed through energy cost stabilization, new output from East Asia and the Middle East, and easing freight rates following 2025 peaks. Buyer risk levels incorporate supplier concentration in China and Indonesia, extended customs clearance timelines in some markets, and policy-driven export windows that influence shipment timing.

Why This Matters for Buyers

For 2026, buyers face a market that is broadly stable but increasingly shaped by policy controls, logistics execution, and regional capacity shifts. Rising demand combined with import reliance underscores the importance of planning procurement around export quota cycles and production ramp-ups to secure volumes ahead of peak application seasons. Medium risk levels highlight the need for multi-origin sourcing strategies to manage costs and ensure continuity. Platform like fertradeasia supports buyers with market transparency, sourcing diversification, and reliable supply chain partnerships to navigate the evolving Asia Pacific urea landscape.

Conclusion

The Asia Pacific urea market in 2026 presents a cautiously balanced outlook, where expanding production capacity tempers price pressure but does not eliminate structural import dependence in key Southeast Asian markets. Demand growth driven by staple crop cultivation and government-backed agricultural programs continues to support steady consumption, while policy interventions and energy-linked cost dynamics remain decisive factors in supply availability. Buyers that adopt forward-looking procurement strategies, diversify sourcing origins, and align purchasing cycles with export and production realities will be better positioned to manage volatility and secure consistent supply in a competitive regional fertilizer market.

Leave a Comment