Introduction

The Asia Pacific citric acid monohydrate market in 2026 reflects stable fundamentals shaped by precision agriculture adoption and sustained fertilizer demand across key importing economies. Procurement strategies increasingly emphasize secure import sourcing, product consistency, and regulatory compliance, as China continues to dominate regional supply while downstream fertilizer applications expand steadily rather than aggressively.

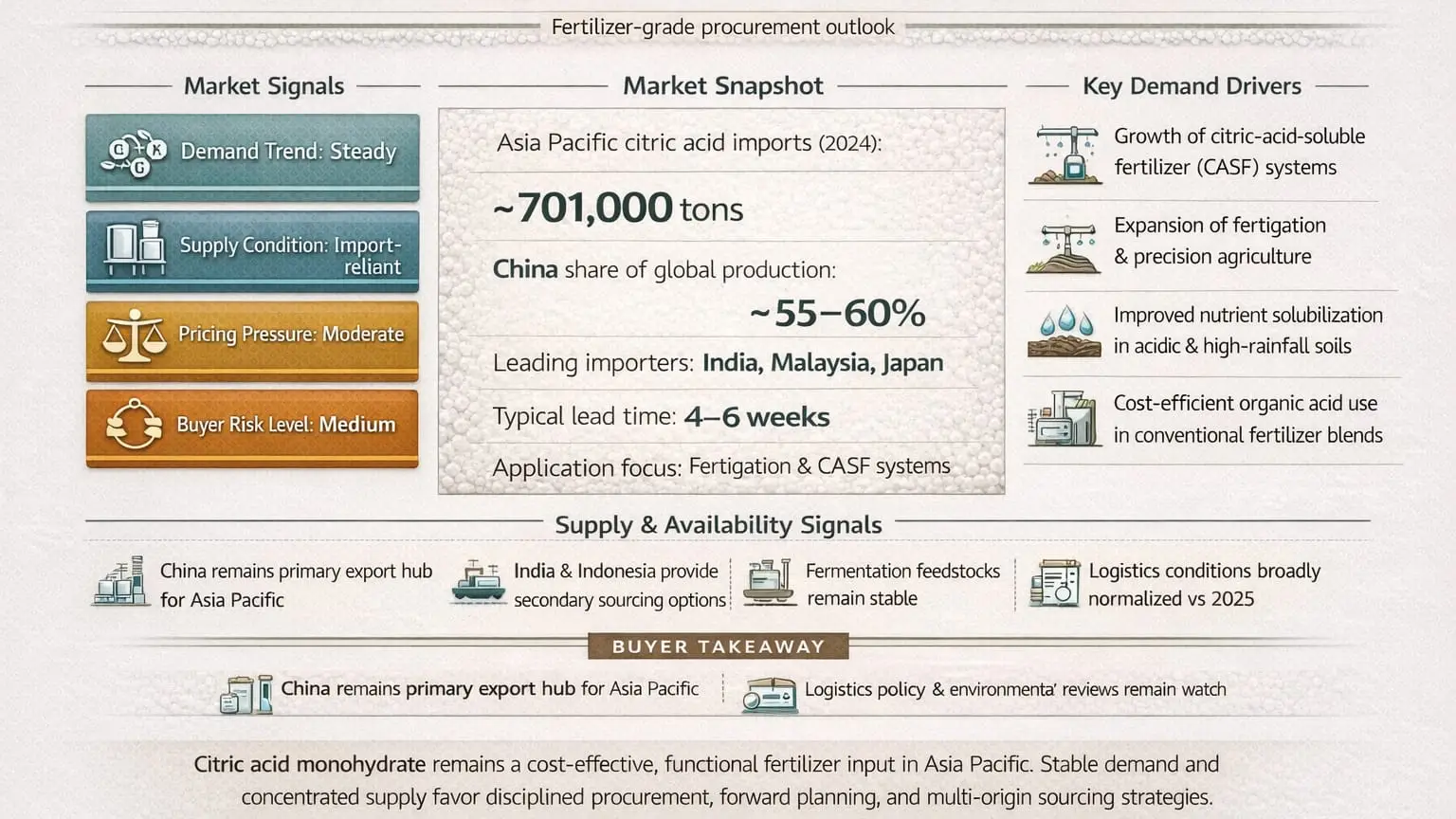

Market Signals for Citric Acid Monohydrate (Asia Pacific, 2026)

Demand trend: Steady

Regional demand for citric acid monohydrate remains stable, supported by Asia Pacific citric acid imports reaching approximately 701,000 tons in 2024, marking a 12% year-over-year increase. Fertilizer usage contributes consistently through applications in fertigation, nutrient solubilization, and citric-acid-soluble fertilizer (CASF) blends. While growth is less pronounced than anhydrous grades used in specialty formulations, monohydrate demand benefits from its cost efficiency and compatibility with conventional fertilizer systems.

Supply condition: Import-reliant

Asia Pacific markets remain structurally import-reliant due to China’s control of roughly 55–60% of global citric acid production capacity. Intra-regional trade flows dominate supply chains, with China serving as the primary exporter to Southeast Asia, Japan, and South Korea, while Indonesia and India play supporting roles. This concentration ensures volume availability but heightens dependency on a limited number of exporting hubs.

Pricing pressure: Moderate

Pricing pressure entering 2026 is assessed as moderate. In Q3 2025, Japanese CIF prices rose by 7.63% to USD 741–774 per metric ton, influenced by overlapping demand from food and pharmaceutical sectors. However, fertilizer buyers anticipate softer pricing trends into 2026 as Asian exporters maintain ample supply and competition intensifies among Chinese producers. Feedstock stability in fermentation processes further tempers extreme price swings.

Buyer risk level: Medium

Buyer risk remains medium due to high supplier concentration in China and exposure to trade policy shifts, logistics disruptions, or environmental enforcement. This risk is partially offset by incremental capacity growth in India and Indonesia, which provides alternative sourcing options and strengthens regional supply resilience for fertilizer-grade material.

Current Market Snapshot

Asia Pacific citric acid monohydrate markets enter 2026 on stable footing, supported by sustained import volumes and predictable trade routes. In 2024, total citric acid imports reached 701,000 tons, with India (147,000 tons), Malaysia (95,000 tons), and Japan (73,000 tons) as leading importers. Fertilizer-grade monohydrate consumption remains steady, benefiting from China’s production dominance and efficient export infrastructure. Despite global citric acid market growth from USD 3.63 billion in 2024, pricing volatility has been limited, and fertilizer buyers report adequate inventories following late-2025 stock rebuilding.

Key Demand Drivers

Demand for citric acid monohydrate in fertilizers is anchored in its functional role within citric-acid-soluble fertilizer systems, where it enhances the dissolution of phosphorus, magnesium, and trace elements in soils. This is particularly valuable in high-rainfall and acidic soil environments common across Southeast Asia, where nutrient runoff and fixation reduce fertilizer efficiency. Expansion of precision agriculture and fertigation systems further supports uptake, as monohydrate grades improve nutrient chelation and bioavailability at relatively low cost. These trends align with Asia Pacific fertilizer market growth at a projected 6.36% CAGR toward USD 240.52 billion by 2030, with micronutrient-enhanced formulations increasingly incorporating organic acids.

Supply & Availability

Regional supply remains concentrated, with China, India, and Indonesia accounting for over half of Asia Pacific capacity. China continues to anchor exports through large-scale fermentation operations, supplying Japan, South Korea, and Southeast Asia with consistent volumes. Import reliance persists, as evidenced by India and Japan’s combined imports exceeding 220,000 tons in 2024, largely sourced from China. Logistics conditions are generally stable, though Red Sea disruptions and fluctuating intra-Asia freight rates remain watch points. Capacity additions in India and Thailand improve sourcing diversity, but periodic anti-dumping measures and regulatory reviews can temporarily tighten availability in select markets.

Buyer Considerations

Procurement teams prioritize suppliers that meet regional compliance standards, including China’s GB 1886.239-2016 specifications, given overlap between food-grade and fertilizer-grade production. Product purity and solubility consistency are critical for fertilizer efficacy, particularly in CASF applications. Lead times typically range from 4 to 6 weeks for shipments from China, underscoring the need for buffer inventories during monsoon seasons or peak agricultural cycles. Pricing exposure remains tied to corn and molasses feedstock trends, favoring multi-origin sourcing strategies that include India and Indonesia to reduce overreliance on China-centric supply.

How These Market Signals Are Interpreted

Demand indicators point to flat-to-modest growth, supported by rising import volumes and stable agricultural output rather than rapid expansion. Supply conditions reflect concentrated capacity in China offset by efficient logistics and emerging regional alternatives. Pricing pressure remains moderate as fermentation energy inputs stabilize and freight rates normalize following 2025 volatility. Buyer risk balances predictable lead times and regulatory clarity against ongoing exposure to supplier concentration and trade policy sensitivity.

Why This Matters for Buyers

For fertilizer manufacturers and distributors, the 2026 citric acid monohydrate landscape favors disciplined procurement rather than aggressive volume expansion. Stable demand and ample supply support cost planning, but import dependence requires proactive inventory and sourcing strategies to mitigate disruption risks. Moderate pricing exposure reinforces the value of forward contracts and diversified origins, especially for high-volume fertigation applications. Fertradeasia supports buyers with market visibility, supplier diversification, and regional sourcing expertise to navigate Asia Pacific citric acid procurement with confidence.

Conclusion

The Asia Pacific citric acid monohydrate market in 2026 presents a balanced environment characterized by steady fertilizer demand, concentrated yet reliable supply, and manageable pricing dynamics. China’s production dominance continues to underpin regional availability, while emerging capacity in India and Indonesia provides incremental diversification for risk-aware buyers. As precision agriculture and nutrient efficiency remain central to fertilizer strategies, citric acid monohydrate retains its relevance as a functional and cost-effective input. Buyers that adopt multi-origin sourcing, maintain buffer inventories, and align procurement with regulatory and seasonal cycles will be best positioned to secure continuity and cost stability in a largely predictable but import-dependent market.

Leave a Comment