Introduction

The Asia Pacific citric acid anhydrous market in 2026 reflects steady expansion driven by fertilizer sector modernization, particularly in water-soluble and specialty nutrient formulations. Procurement decisions are increasingly influenced by import dependencies, feedstock-linked pricing dynamics, and the reliability of export-led supply chains serving Southeast Asia’s growing fertigation and precision agriculture segments.

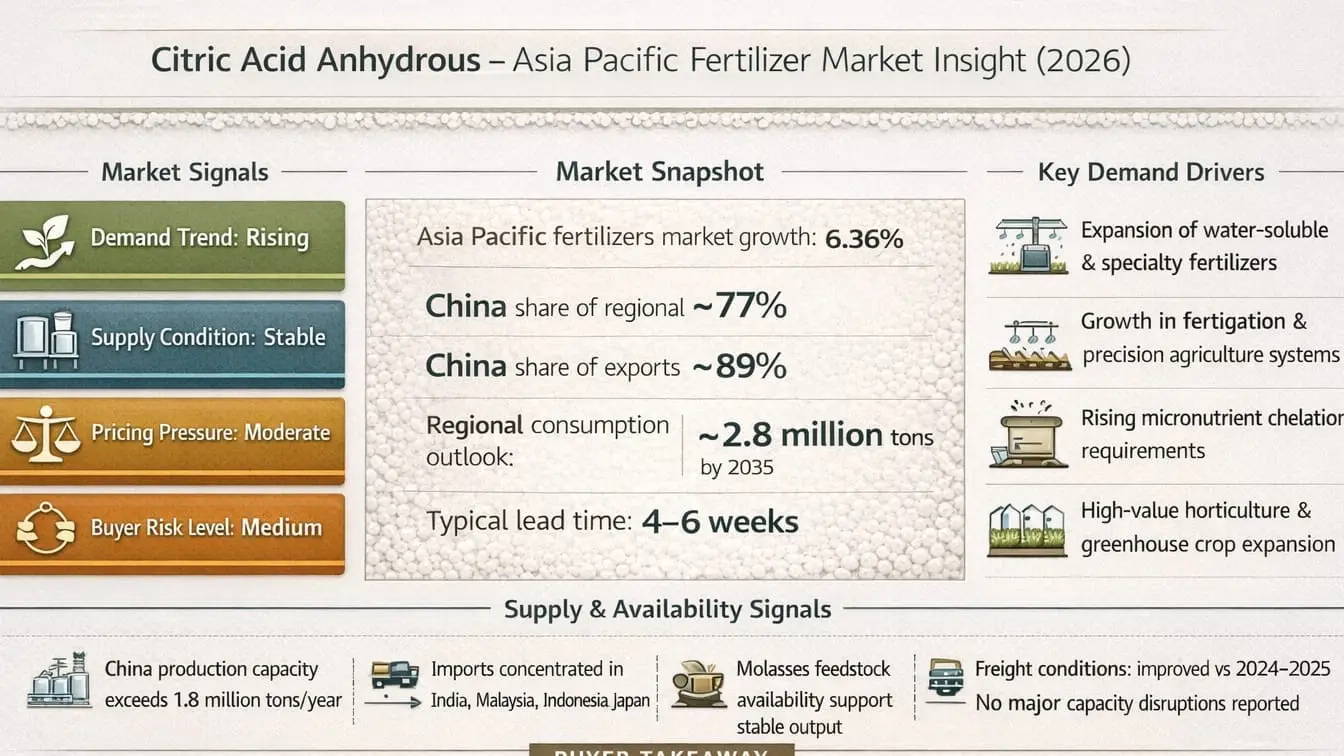

Market Signals for Citric Acid Anhydrous (Asia Pacific, 2026)

Demand trend: Rising

Asia Pacific fertilizers market projected to grow from USD 176.70 billion in 2025 at 6.36% CAGR, with specialty fertilizers expanding in Southeast Asia for fertigation systems where citric acid aids nutrient chelation.

Supply condition: Stable

China holds 77% of regional production and 89% of exports, supported by over 1.8 million metric tons annual capacity from abundant molasses feedstocks.

Pricing pressure: Moderate

Q3 2025 prices stable to slightly declining in India (USD 849–936/MT) and Thailand, with forecasts indicating controlled rises tied to feedstock and logistics costs into 2026.

Buyer risk level: Medium

High reliance on China exports amid concentrated sourcing, though diverse importers like India (147K tons) and Malaysia mitigate some exposure through growing regional trade.

Current Market Snapshot

Asia Pacific citric acid anhydrous trade remains active and well supplied, with regional consumption forecast to grow at a 1.6% CAGR to approximately 2.8 million tons by 2035. Fertilizer and food sectors jointly drive volume stability, while specialty fertilizer formulations introduce selective demand tightness. Between 2024 and 2025, imports into India (147,000 tons), Malaysia (95,000 tons), and Indonesia (36,000 tons) accounted for roughly 67% of regional trade volumes, highlighting continued dependence on cross-border sourcing. Pricing conditions stayed firm in India during Q3 2025, while Japan experienced higher CIF levels due to pharmaceutical demand, illustrating sectoral divergence within an otherwise balanced market.

Key Demand Drivers

Demand growth is underpinned by fertilizer sector transformation across Southeast Asia. Producers such as Vietnam’s PVFCCo and Pupuk Indonesia are expanding water-soluble and controlled-release fertilizer portfolios to support high-value horticulture exports. Citric acid anhydrous plays a functional role in these formulations by chelating micronutrients, enhancing nutrient uptake, and improving fertigation efficiency. This aligns with Indonesia’s 6.43 million ton urea production target and broader investments in drip irrigation and greenhouse cultivation. In India and Thailand, agricultural intensification and soil remediation initiatives further sustain usage, particularly in precision nutrient delivery and specialty feed applications.

Supply & Availability

China continues to dominate supply, with production capacity exceeding 1.8 million tons annually, supported by cost-efficient molasses fermentation. Export flows primarily target India, Japan, and Southeast Asia, reinforcing China’s role as the regional supply backbone. Import patterns show increasing diversification in certain markets, as Malaysia’s imports expanded at a 22.4% CAGR through 2024, partly routing volumes via Indonesia and Thailand as secondary hubs. Logistics conditions remained stable through late 2025, with softened freight rates contributing to competitive FOB pricing from Thailand. No major capacity disruptions were reported, and ongoing expansions in China are expected to maintain surplus availability despite rising global demand.

Buyer Considerations

Industrial buyers should prioritize suppliers with verified GMP and traceability standards, particularly for fertilizer formulations subject to export and regulatory scrutiny. Dual-sourcing strategies combining Chinese and regional suppliers can reduce concentration risk and improve supply resilience. Lead times of 4–6 weeks for spot shipments support forward planning, especially as molasses feedstock volatility and residual Red Sea rerouting effects may influence costs. Bulk tenders for early 2026 delivery provide opportunities to secure pricing below USD 950 per metric ton. Compliance with REACH-like standards in markets such as Japan and Australia also reinforces the need for transparent documentation and consistent quality.

How These Market Signals Are Interpreted

Demand signals are derived from fertilizer market expansion at a 6.36% CAGR and sustained import growth in Southeast Asia, particularly in specialty applications rather than commodity volumes. Supply stability reflects China’s oversized capacity and reliable export infrastructure, offsetting the risks associated with high production concentration. Pricing pressure remains moderate as stable Q3 2025 trends balance incremental feedstock and energy cost increases. Buyer risk assessments consider predictable lead times, moderate supplier concentration, and increasing alignment with ASEAN and OECD-style compliance frameworks.

Why This Matters for Buyers

For fertilizer manufacturers and distributors, the 2026 outlook supports proactive procurement planning amid stable supply and rising specialty demand. While China’s dominance ensures availability, it also necessitates diversification strategies to manage exposure to policy or logistics disruptions. Visibility into pricing trends, import flows, and feedstock dynamics enables buyers to optimize inventory positions and working capital as Southeast Asia’s fertilizer markets expand. Fertradeasia supports these objectives through regional market intelligence, diversified sourcing networks, and reliable supply chain partnerships tailored to fertilizer sector requirements.

Conclusion

The Asia Pacific citric acid anhydrous market in 2026 is characterized by stable supply fundamentals and steadily rising demand from specialty fertilizer applications, particularly in fertigation and precision agriculture. China’s dominant production capacity underpins regional availability and moderates pricing volatility, though reliance on a concentrated export base sustains medium procurement risk. As fertilizer producers shift toward higher-value, micronutrient-enhanced formulations, citric acid’s functional role becomes increasingly strategic rather than purely volumetric. Buyers that secure forward contracts, diversify sourcing channels, and align procurement with regulatory and quality standards will be best positioned to manage cost exposure and ensure continuity in a growing and increasingly specialized regional market.

Leave a Comment