Introduction

Manganese carbonate plays a strategic role as a micronutrient input in Asia Pacific fertilizer formulations, particularly for correcting manganese-deficient soils that constrain crop productivity. In 2026, procurement decisions are increasingly shaped by regional agricultural expansion, fertilizer policy support, and structurally import-reliant supply chains. As fertilizer producers shift toward more balanced nutrient blends, manganese carbonate demand continues to move from discretionary supplementation toward a recurring input aligned with yield optimization strategies.

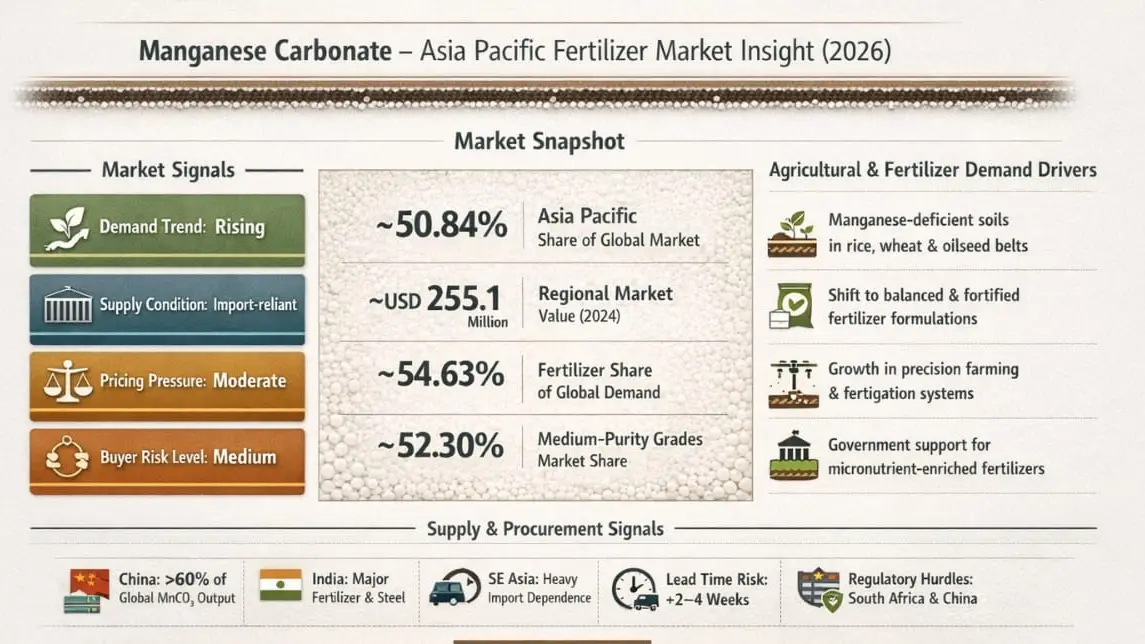

Market Signals for Manganese Carbonate (Asia Pacific, 2026)

Demand trend: Rising

Asia Pacific accounted for 50.84% of the global manganese carbonate market in 2024, valued at approximately USD 255.1 million, and is projected to grow at a 5.31% CAGR through 2032. Fertilizer applications represent the largest demand segment globally, comprising 54.63% of total use, driven by increasing recognition of micronutrient deficiencies across major crop belts. In Asia Pacific, rice, wheat, and oilseed cultivation intensifies consumption, particularly in China, India, and Southeast Asia, where soil depletion from continuous farming elevates micronutrient requirements.

Supply condition: Import-reliant

Supply conditions remain import-reliant despite China’s dominance in production, largely centered around Guangxi manganese ore reserves. Regional consumption exceeds 62% of global demand, placing pressure on cross-border supply flows. India alone consumes approximately 1.2 million metric tons annually across its steel and fertilizer value chains, creating competition for material availability and signaling continued reliance on imports for Southeast Asian markets that lack domestic beneficiation capacity.

Pricing pressure: Moderate

Pricing pressure is moderate, influenced by manganese ore volatility, logistics disruptions, and intermittent supply constraints such as the port shortages experienced in China during 2024. These pressures are partially offset by steady demand from fertilizer and steel sectors, which provides a stable offtake base and limits extreme price swings. As a result, prices remain range-bound, allowing buyers to plan procurement without severe cost shocks.

Buyer risk level: Medium

Buyer risk is assessed at a medium level due to environmental regulation tightening and logistics bottlenecks in key producing regions. South Africa, which holds roughly 30% of global manganese reserves, faces regulatory changes and infrastructure constraints that introduce lead time variability. Combined with high supplier concentration, these factors require buyers to adopt proactive sourcing and inventory strategies.

Current Market Snapshot

Asia Pacific demand for manganese carbonate in fertilizer applications continues to reflect steady agricultural output growth. Globally, the fertilizer segment was valued at approximately USD 227.46 million in 2024, holding a dominant 54.63% market share. Trade activity is centered on China as the primary exporter, supporting India’s high consumption levels amid growing awareness of micronutrient soil deficiencies. Pricing remains relatively stable despite ore supply disruptions, with medium-purity grades accounting for around 52.30% of market share due to their cost-effectiveness and suitability for bulk fertilizer blending. Overall market conditions favor volume procurement, though buyers must actively monitor port inventories and shipping schedules.

Key Demand Drivers

Expansion of sustainable and productivity-focused farming practices is a key driver of manganese carbonate demand, as the compound addresses micronutrient deficiencies that impair photosynthesis and reduce crop yields. In major rice and wheat belts across China, India, and Southeast Asia, balanced fertilization programs increasingly incorporate manganese sources. Fertilizer consumption rises further with stabilized weather patterns following La Niña-related disruptions, supporting higher planting intensity. Precision agriculture and fertigation systems amplify micronutrient usage efficiency, while government subsidy programs for fortified fertilizer blends accelerate adoption at the farm level.

Supply & Availability Signals

Production capacity is heavily concentrated in China, which accounts for over 60% of global manganese carbonate output, supported by integrated mining and processing operations in Guangxi. India continues to invest in downstream processing to reduce import dependency, though progress remains incremental. Southeast Asia relies primarily on imports from China, South Africa, and Gabon, where limited local beneficiation constrains alternative supply options. Logistics face persistent challenges, including Red Sea route disruptions and congestion at Chinese ports, extending lead times by an estimated two to four weeks. Regulatory developments such as South Africa’s planned 50% domestic processing requirement by 2025 further tighten export availability.

Buyer Considerations

Procurement teams prioritize suppliers with verified compliance to REACH-like standards and environmental controls, particularly in China and India, as scrutiny around heavy metal emissions and traceability intensifies. Buyers increasingly secure three- to six-month lead times to buffer logistics volatility and reduce exposure to shipping disruptions. Pricing risk management favors indexed contracts tied to manganese ore benchmarks, with energy costs accounting for roughly 15–20% of total production expenses. Dual-sourcing strategies that blend domestic and imported medium-purity grades support fertilizer formulation stability and mitigate single-origin dependency.

How These Market Signals Are Interpreted

Demand indicators track rising imports into India and Indonesia alongside fertilizer market value growth of approximately 5.85% CAGR, confirming sustained agricultural pull into 2026. Supply conditions reflect high concentration in China and South Africa, with limited diversification options exacerbated by logistics bottlenecks such as cyclone impacts in 2024. Pricing pressure is driven by energy inflation and freight surges, though moderated by economies of scale in Asian production. Buyer risk stems from supplier concentration, regulatory shifts, and compliance requirements, underscoring the importance of diversified procurement strategies.

Why This Matters for Buyers

For fertilizer producers and distributors, the 2026 manganese carbonate market demands early planning aligned with planting seasons and nutrient program cycles. Rising demand and moderate cost escalation require securing volumes in advance while managing inventory buffers to offset import reliance and logistics risk. Buyers that proactively diversify sourcing and monitor regulatory and logistics developments will be better positioned to maintain formulation stability and support crop yield targets. Platform like fertradeasia.com enables buyers to navigate these dynamics through sourcing visibility, market intelligence, and reliable supply chain partnerships across Asia Pacific.

Conclusion

The Asia Pacific manganese carbonate market in 2026 is defined by structurally rising demand from fertilizer applications, balanced against concentrated and import-reliant supply chains. While pricing remains moderately stable, regulatory tightening and logistics constraints elevate procurement risk to a manageable but persistent level. Buyers that adopt forward contracting, diversified sourcing, and disciplined inventory planning will be best equipped to secure supply continuity and cost control as agricultural micronutrient demand continues to expand across the region.

Leave a Comment